THE YEAR 2020 WAS MARKED BY THE COVID-19 PANDEMIC and the global downturn in the economy. Yet it still was a good year for the LCD industry. PC shipments surged, because more people worked from home and schools moved their classes online. The unexpected demand for LCD panels pushed prices and profits higher, giving some much-needed breathing room to the suppliers.

This is only temporary, though. As COVID-19's short-term effects fade, the challenges facing LCD suppliers will re-emerge. Overcapacity remains a longstanding issue and the inevitable market correction is going to completely remap the industry landscape. As Ross Young explained in Information Display last year,1 capital equipment investment in China has led manufacturers outside China to shut down or downsize their LCD fabrication plants (fabs). Now Korea—which used to have the largest share of LCD capacity—will only have one production line running once Samsung finally closes its LCD business (initially planned for the end of 2020).

Then there is the competition with OLED for the most profitable market segments. OLED is quickly gaining market share in mobile displays, with fifth-generation technology (5G) pushing the requirement for displays to consume less power. In the TV segment, LCD remains the dominant technology, but OLED can still command a higher price thanks to its perfect black and high contrast. Display manufacturers also are prioritizing investment in new OLED fabs. Between 2020 and 2025, the compound annual growth rate (CAGR) for OLED TV capacity is projected to be 32 percent, which will increase their share of global display capacity from 2 to 7 percent. Although the situation remains fluid, LCD TV capacity will grow at a much smaller rate during the same period, which will result in a decrease in their share of global capacity.2

However, LCD is a technology that has always evolved to respond to new challenges. In this context, the introduction of miniLED backlights is the latest move to answer OLED's threat. With miniLED backlights used for local dimming, LCD panels can offer greatly improved high dynamic range (HDR) performance without a noticeable increase in panel thickness. Overall, power consumption should also be lower, depending on the type of content.

The technology was first commercialized in 2019, in 32-inch professional monitors by Apple and Asus, and in TVs by TCL. The idea was to use smaller LEDs (50 to 300 micrometers [μm] in size) to increase the number of local dimming zones in direct-lit backlights. In 2020, the trend continued in smaller panels, with Micro-Star International (MSI) releasing the first 17-inch laptop with a miniLED backlight. Apple is now expected to launch a 12.9-inch miniLED tablet in in the first quarter of 2021.

This year will be pivotal for miniLED. According to Display Supply Chain Consultants (DSCC's) latest analysis, total miniLED backlight shipments will jump from 0.05 million units in 2020 to 8.9 million units in 2021. By 2025, volumes will reach 48 million units, with TVs as the largest segment.3

This market uptake is influenced partly by Samsung Electronics’ decision to introduce miniLED backlights in their 2021 “Neo QLED” range of premium quantum-dot LED TVs, even though Samsung Display Corporation (SDC) is now focused on manufacturing QD-OLED TV panels (blue OLED with printed quantum-dot color converters). This has led to an unusual situation in which Samsung Electronics may not be the primary customer for SDC's QD-OLED, at least in the first year of production. There are three reasons that can explain the decision. First, the QD-OLED fab has not started mass production yet, so there are higher risks of delays and low yields. Second, miniLED is an incremental upgrade to the current technology based on quantum-dot enhancement films (QDEF) in the backlight. Third, Samsung Electronics has already spent a considerable amount in research and development and marketing to pit microLED technology as the main competitor to OLED for the market's ultra-premium end.

MicroLEDs, usually defined as LED chips measuring less than 100 μm, are even smaller than miniLEDs and are used to make direct-view displays. Samsung Electronics has previously demonstrated large modular screens (The Wall) which were not “true” microLED displays, because they used larger LED chips. However, it allowed Samsung to promote an alternative to OLED that promised the best contrast, a higher peak brightness, and larger screen sizes. Samsung now has announced a new 110-inch microLED TV for 2021, but the retail price is still above $150,000, due to high manufacturing costs. Clearly, microLED is positioned as a luxury option and in the short term, volumes will only be in the few thousands. On the other hand, miniLED can improve contrast while competing in the same price range as OLED in the advanced TV market. Samsung reportedly targeted sales of 2 million miniLED backlit LCD TVs for 2021. Its rival, LG Electronics, responded by announcing a new range of miniLED backlit TVs, with a flagship model featuring 8K resolution and nearly 2,500 local dimming zones. Other TV brands are following.

In the advanced TV market, the battle will stay mainly between QD-LCD and OLED. Shipments for OLED TVs, which include both white-OLED and QD-OLED, are forecasted to increase to 12 million units by 2024. However, QD-LCD TVs will grow faster, with shipments reaching 18 million in 2024 (Fig. 1). MiniLED adoption in QD-LCD will grow even faster and by 2022, so that shipments of miniLED backlit TVs outnumber OLED TVs.

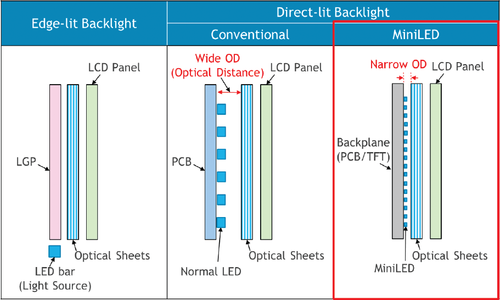

The addition of miniLED backlights will be particularly important for HDR content as the higher number of local dimming zones help minimize halo effects often found with standard direct-lit backlights. MiniLEDs also bring benefits in terms of form factor, because the smaller LEDs help reduce the module's total thickness. This is an important consideration when competing against ultra-thin OLED panels. With conventional direct-lit backlights, the spacing between LEDs usually impose a wide optical distance (OD) between the printed circuit board (PCB) and various optical sheets—such as the diffuser film, brightness enhancement film (BEF), dual BEF (DBEF), and quantum dots. To achieve a slim form factor, LCD TV manufacturers previously had to compromise on image quality and choose edge-lit backlights, which are not capable of local dimming in two dimensions.

With miniLEDs, the chips’ density is significantly increased and the OD can be much shorter, so miniLED backlights can deliver superior HDR performance and be almost as thin as edge-lit backlights. This is something TCL emphasized specifically at the Consumer Electronics Show (CES) this year, with the “OD Zero” feature on their new TV models.

Fig 2

Backlight configurations for LCD. Optical sheets can include a quantum dot enhancement film. LGP= light guide plate; PCB = printed circuit board; TFT = thin-film transistor. Source: DSCC report3

However, miniLED backlights also add more complexity and cost. The number of LED chips is much higher than with a conventional backlight, so the bill of materials (BoM) automatically increases. The miniLED array also requires its own backplane, which is separate from the LCD backplane. Simple passive-matrix backplanes are currently based on PCBs, but backlights with a high number of dimming zones will likely require a thin-film transistor (TFT) backplane (active matrix). Keep in mind that the LEDs are current-driven, so the circuit for each dimming zone will need multiple TFTs to provide the correct amount of compensation. We can expect the yield for active-matrix backplanes to be low initially, as we saw when OLED TV panels began to be mass produced. TCL reportedly is using amorphous silicon TFTs to drive the backlight in their premium 8K Vidrian model. The product demonstration last year was impressive, but TCL has been noticeably slow to start shipping this model.

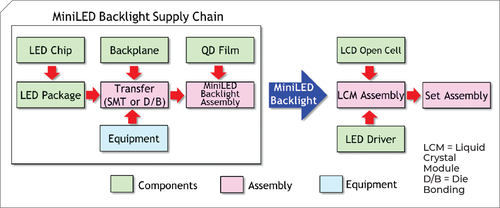

Fig 3

Supply chain for miniLED backlit LCD. SMT = surface mount technology. Source: DSCC report3

Currently, LED chips are packaged and then transferred onto the backplane using either surface mount technology (SMT) or die bonding. Even for a TV with fewer than 600 dimming zones, more than 8,000 LED chips must be transferred. Higher-end models will have more than 25,000 LED chips. For laptops and tablets, the constraint on module thickness means the OD and chip size decrease, which puts more emphasis on placement accuracy. The transfer process is therefore a critical step in the supply chain, yet none of the traditional LCD assembly houses have the tools or know-how. LED chip manufacturers such as Sanan and Lextar will aim to capture additional value by selling pre-assembled arrays. Smaller chips will be based on chip-onboard (COB) technology, to transfer bare dies instead of fully packaged chips. In this case, the PCB substrate probably will be made with Bismaleimide-Triazine (BT resin), a more expensive material than conventional FR4 PCB (FR4 is a common flame-retardant material grade).

The addition of a quantum-dot film may be optional, but many TV makers will choose to include it to beat OLED on the color gamut. DSCC's analysis indicates that QD film's cost will likely drop from $19 to $11 per square meter within 5 years.5 This is partly attributable to the quantum dots’ increased robustness, which has allowed lower barrier requirements on the film. Manufacturers are also continuously improving QD material utilization to reduce the quantity needed in each film. Unfortunately, this is not enough to offset miniLED backlights’ additional cost.

Cost simulations for 65-inch QD-LCD panels manufactured in China (Generation 10.5 substrate) show that adding a lower-end miniLED backlight (with < 10,000 LED chips) nearly doubles the total module cost. This means that miniLED with QD is only a slightly lower cost than an OLED panel of the same size. MiniLED backlights with more zones and active-matrix backplanes will push the cost much higher than OLED. An acceptable compromise might be to limit the number of LED chips (between 25,000 and 30,000) and use COB on a passive-matrix PCB backplane. DSCC finds that such a configuration would still be more expensive than OLED today, with the backlight alone costing more than $500.3

MiniLED will not always win on cost. However, for larger display sizes (75 inches and higher), OLED becomes less competitive, because it does not scale easily. In this case, QD-LCD with miniLED can cost 20 percent less than OLED.

For premium laptop displays, the competition will be more challenging because the cost of rigid OLED panels is expected to drop faster than the cost of miniLEDs. DSCC estimates that a 15.6-inch 4K panel with both miniLED and QDEF costs only 5 to 6 percent less than OLED.3 By 2025, the difference will be negligible. However, miniLED backlit displays should have an advantage in terms of peak brightness and lifetime (no burn-in or color shift). Allegedly, Apple is developing miniLED backlights for future MacBook Pros.

The durability and ability to withstand harsh environmental conditions also should make miniLEDs more appealing for the automotive market, where OLED has been noticeably slow to get any traction.

MiniLED is an exciting new development in the LCD industry. As the volumes increase and the supply chain matures, we can expect the costs to diminish. While it may not beat OLED in the mobile display market, miniLED is seriously stepping up the competition in TV, IT, and automotive displays.

From:SID-Wiley Online Library

中文

中文 日本語

日本語 한글

한글 English

English Return

Return